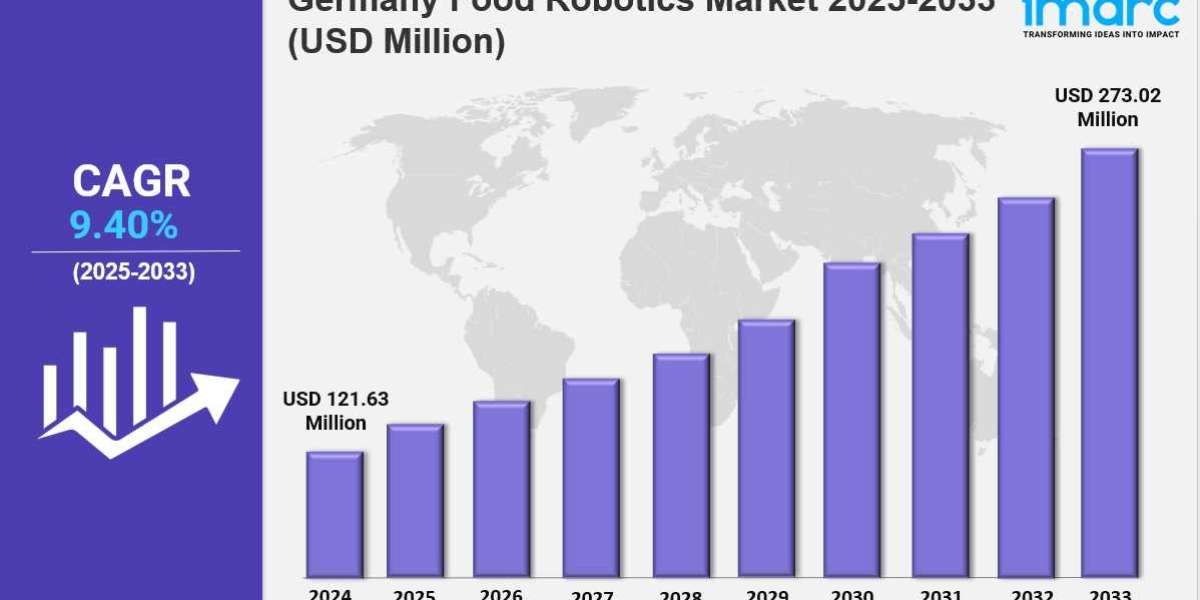

Market Overview 2025-2033

The Germany food robotics market size reached USD 121.63 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 273.02 Million by 2033, exhibiting a growth rate (CAGR) of 9.40% during 2025-2033. The market is expanding due to increasing automation in food processing, rising demand for efficiency, and advancements in AI and robotics. Labor cost reduction, food safety regulations, and technological innovations are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by increasing automation in food processing and packaging

✔️ Rising adoption of AI-powered robots for precision, efficiency, and hygiene compliance

✔️ Expanding investment in smart manufacturing and Industry 4.0 innovations

Request for a sample copy of the report: https://www.imarcgroup.com/germany-food-robotics-market/requestsample

Germany Food Robotics Market Trends and Drivers:

Germany food robotics market is growing fast due to labor shortages. An aging workforce and less interest in repetitive jobs push companies to use robots for productivity. Collaborative robots, or cobots, are now popular for tasks like packaging, sorting, and quality control. They work alongside human workers and boost precision. For example, in 2024, meat processing plants in Bavaria used vision-guided robotic arms for delicate cuts. This reduced waste by 22% and improved hygiene after the pandemic.

This support keeps Germany competitive in global food exports. The trend is changing supply chains. Robotics-as-a-service (RaaS) models allow smaller producers to access these technologies. Environmental rules and consumer demand for eco-friendly practices are driving progress in energy-efficient food robotics. German engineers focus on low-power actuators and AI systems that optimize resources. For example, they reduce water use in vegetable washing by 35%. In 2024, startups like BioBot Solution launched modular robots that turn food waste into biofuels within factories. This aligns with the EU’s Circular Economy Action Plan. Meanwhile, big companies like Siemens and KUKA are adding carbon footprint trackers to their robotic controllers.

This allows for real-time sustainability audits. This change meets regulations and serves as a branding strategy. Companies like ALDI Nord use “green robotics” to attract eco-conscious customers. The push for net-zero operations has made solar-powered autonomous mobile robots (AMRs) common in logistics hubs, such as Frankfurt’s food distribution centers. Rising demand for personalized nutrition and limited-edition products is pushing manufacturers to use agile robotic systems. These systems can quickly change setups. For instance, chocolate makers in Cologne use 3D-printing robots. They create custom designs for seasonal markets, cutting retooling time from days to hours.

In 2024, AI-powered sensory robots appeared. They can adjust recipes based on real-time consumer feedback collected through IoT devices. This hyper-customization is clear in plant-based meat alternatives. Here, robotic arms change texture and flavor profiles during extrusion. Such flexibility reduces downtime and inventory costs. This allows companies like Rügenwalder Mühle to launch over 12 product variants each year. The trend shows a wider shift in the industry toward high-margin, niche markets.

The German food robotics sector is undergoing a paradigm shift, fueled by technological convergence and evolving consumer expectations. While labor cost savings remain a key driver, the focus has expanded to encompass predictive maintenance enabled by digital twins and edge computing. For instance, in 2024, over 60% of new installations incorporated machine learning algorithms that preempt equipment failures, reducing unplanned downtime by 40%.

Another critical trend is the integration of robotics with blockchain for traceability, as seen in Müller Group’s dairy farms, where milking robots timestamp production data on immutable ledgers. Geopolitical factors, such as nearshoring post-Ukraine conflict, have also spurred demand for localized, robot-driven production hubs to mitigate supply chain risks. However, challenges persist, including high upfront costs and a skills gap in robot programming. Looking ahead, partnerships between Fraunhofer Institutes and vocational academies aim to standardize certification programs, ensuring sustained innovation in this $1.2 billion market.

Germany Food Robotics Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

- SCARA

- Articulated

- Parallel

- Cylindrical

- Others

Breakup by Payload:

- Low

- Medium

- Heavy

Breakup by Application:

- Packaging

- Repackaging

- Palletizing

- Picking

- Processing

- Others

Breakup by Region:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145