Market Overview 2025-2033

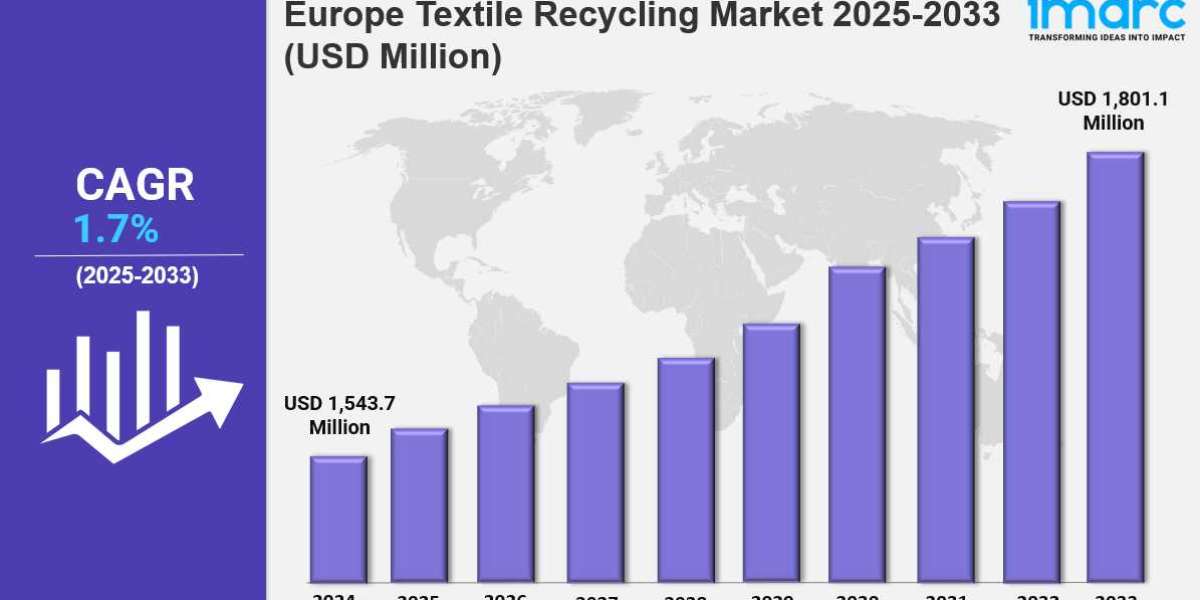

The Europe textile recycling market size reached USD 1,543.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,801.1 Million by 2033, exhibiting a growth rate (CAGR) of 1.7% during 2025-2033. The market is growing due to rising sustainability awareness, increasing government regulations, and demand for circular fashion. Technological advancements, eco-friendly initiatives, and expanding recycling infrastructure are key factors driving industry expansion.

Key Market Highlights:

✔️ Strong market growth driven by increasing sustainability awareness and circular economy initiatives

✔️ Rising demand for recycled fibers in fashion, home textiles, and industrial applications

✔️ Expanding government regulations promoting textile waste reduction and eco-friendly production

Request for a sample copy of the report: https://www.imarcgroup.com/europe-textile-recycling-market/requestsample

Europe Textile Recycling Market Trends and Drivers:

The Europe textile recycling market is experiencing accelerated growth as sustainability evolves from a trend into a key legislative and corporate priority. The European Union’s ambitious targets—such as a 65% reduction in textile waste by 2030 and mandatory recyclability for all clothing by 2035—are driving the transition toward a circular economy. These mandates are reshaping industry strategies and spurring significant investments in recycling technologies and infrastructure. Countries like Germany and France are taking the lead, offering tax incentives for companies using recycled textiles like polyester. The EU’s recent ban on landfilling textiles has also fueled momentum, significantly contributing to Europe textile recycling market growth and driving expansion across the continent.

However, despite this positive trajectory, structural challenges remain. The Europe textile recycling industry size is limited by disparities in recycling capabilities, material quality, and policy frameworks among member states. Still, consumer expectations are fueling rapid change. A 2024 report on the Europe textile recycling market demand revealed that 72% of consumers now prefer brands with verifiable recycling initiatives. Fashion giants like HM and Zara are responding with blockchain-based tracking systems and extensive collection programs—reclaiming over 120,000 tons of used garments in the past year alone.

Innovation continues to play a pivotal role in advancing the industry. Companies like Circularise and Fairbrics are partnering with luxury fashion houses to transform post-consumer waste into premium materials, elevating both visibility and value in circular fashion. In 2024, for the first time, the cost of recycling textiles began to compete with that of virgin production—signaling a tipping point for sustainable sourcing. Pioneers such as Renewcell, which produces Circulose® from mixed-fiber garments, and Carbios, which chemically breaks down textiles into reusable polymers, are setting new standards and expanding the Europe textile recycling market share across high-value applications.

Investor interest has surged in parallel. In 2024, the sector secured €1.3 billion in fresh funding, with the EU supporting 14 new large-scale recycling initiatives aimed at boosting capacity. Nevertheless, high energy consumption and fragmented regulatory landscapes still pose hurdles. Current recycling rates stand at just 32%, far below the EU’s 45% goal for 2025. Yet, with mounting Europe textile recycling market demand, the trajectory remains encouraging.

According to the latest data, recycled fibers now comprise 18% of Europe’s total textile output—twice as much as in 2022. Germany’s impressive network of 300 companies, collectively recycling 85% of their textile waste, sets an example for the rest of Europe. Beyond fashion, industries such as automotive and construction are fueling additional Europe textile recycling market growth, using recycled fabrics for insulation, lining, and soundproofing. These applications alone are seeing over 20% annual growth, significantly boosting the Europe textile recycling industry size.

Still, inconsistencies in textile collection persist—ranging from as low as 28% to over 60% across different nations. In response, the EU is piloting smart textile tracking and AI-powered sorting systems across 15 member states, with full rollout expected by the end of 2025.

Looking ahead, the future of the European textile recycling market is filled with opportunity. As technology, consumer behavior, and regulatory frameworks continue to align, the region is poised for robust Europe textile recycling market growth across both traditional and emerging sectors. From fashion to construction, textile recycling is becoming a critical pillar in Europe’s broader sustainability agenda, with the Europe textile recycling industry size projected to expand substantially over the next decade.

Europe Textile Recycling Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

- Cotton Recycling

- Wool Recycling

- Polyester Polyester Fibre Recycling

- Nylon Nylon Fibre Recycling

- Others

Breakup by Textile Waste:

- Pre-consumer Textile

- Post-consumer Textile

Breakup by Distribution Channel:

- Online Channel

- Retail Departmental Stores

Breakup by End Use:

- Apparel

- Industrial

- Home Furnishings

- Non-woven

- Others

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145