Market Overview 2032

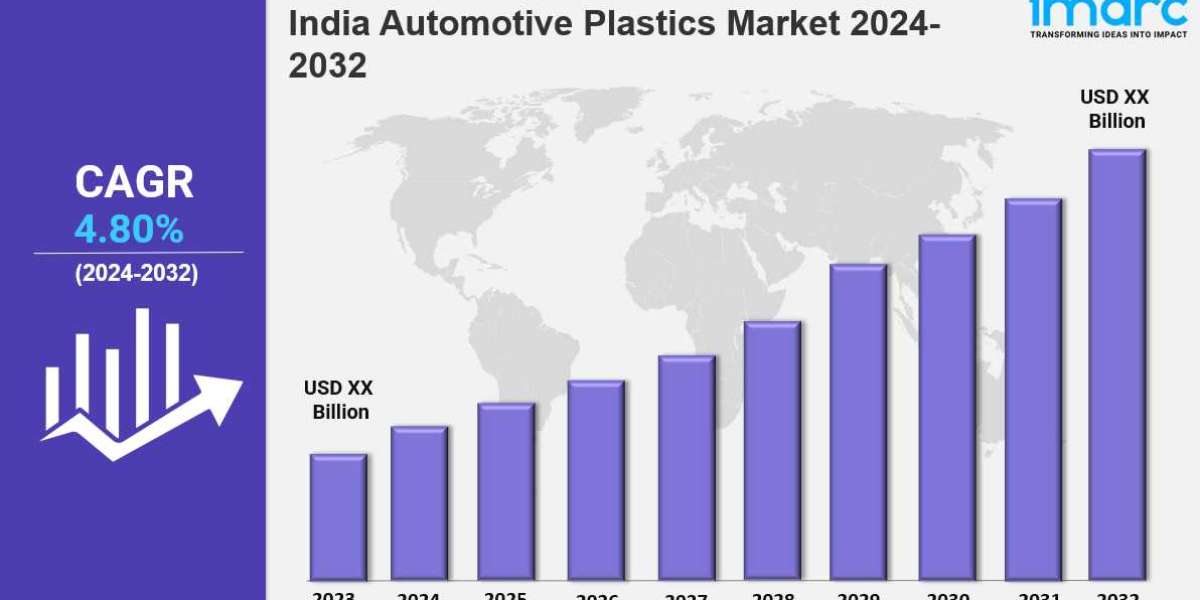

India automotive plastics market size is projected to exhibit a growth rate (CAGR) of 4.80% during 2024-2032. The market is expanding due to increased demand for lightweight, fuel-efficient vehicles. Innovations in materials and sustainability efforts are driving the use of plastics in automotive manufacturing, contributing to the industry's overall growth and evolution.

Key Market Highlights:

✔️ Strong market growth driven by rising vehicle production and lightweight material adoption

✔️ Increasing demand for fuel-efficient and electric vehicles boosting plastic component usage

✔️ Expanding focus on sustainable and recyclable automotive plastic solutions

Request for a sample copy of the report: https://www.imarcgroup.com/india-automotive-plastics-market/requestsample

India Automotive Plastics Marke Trends and Driver:

The India automotive plastics market is moving towards the use of lightweight materials, driven by the need for improved fuel efficiency and reduced emissions. Automakers are working to meet strict environmental regulations and growing consumer demands, leading to an increase in demand for lightweight components. Plastics are becoming a preferred choice because they are lighter than traditional materials like metal.

This trend is visible in both passenger and commercial vehicles, as manufacturers invest in advanced polymers and composites that offer strength while keeping weight low. Innovations such as reinforced plastics and bio-based materials are emerging to meet the dual needs of sustainability and performance. As a result, the automotive plastics market in India is expected to grow, with projections indicating a strong compound annual growth rate (CAGR) through 2024 and beyond.

The rise of electric vehicles (EVs) is also transforming the Indian automotive plastics market. Government support for electric mobility, combined with growing consumer interest, is driving demand for specialized plastic components in EVs. Plastics play a key role in battery enclosures, lightweight body panels, and interior parts, enhancing overall efficiency. Their light weight improves the range and performance of EVs, making them critical for EV production. Innovations in thermal management and flame-retardant plastics are vital for ensuring safety and efficiency.

As the EV market expands, fueled by favorable policies and consumer demand, the need for automotive plastics is expected to rise significantly by 2024. This trend will further solidify the role of plastics in the automotive industry. Sustainability is also a major focus for the Indian automotive sector, and it is having a significant impact on the automotive plastics market. Increasing awareness of environmental issues is driving demand for responsible manufacturing practices.

This shift has resulted in a growing trend of using recycled plastics in vehicles. Manufacturers are exploring ways to incorporate post-consumer recycled materials into their production processes, aligning with global sustainability goals. This approach not only addresses environmental concerns but also reduces costs by lowering raw material expenses. The development of biodegradable plastics is also gaining momentum, helping to reduce the environmental impact. As consumers increasingly seek eco-friendly products, automotive manufacturers are adjusting their strategies to meet these demands. This has led to a significant increase in the use of sustainable plastics, a trend that is expected to grow through 2024 as companies aim to enhance their sustainability profiles and comply with regulatory requirements.

The Indian automotive plastics market is poised for significant changes, with several key trends reshaping the industry. One major trend is the adoption of advanced technologies. Automation and smart manufacturing are becoming more common as manufacturers seek greater efficiency and precision in producing automotive plastics. The use of robotics and artificial intelligence is improving productivity and the quality of plastic components.

Additionally, there is a growing demand for customized solutions as consumers seek personalized features in their vehicles. This is driving the production of specialized plastic parts to cater to different preferences. Investment in the sector is also on the rise, with both domestic and international players looking to capitalize on the demand for lightweight and sustainable materials. As the market evolves, innovation, sustainability, and consumer-driven designs will play a key role in shaping the future of automotive plastics in India. These factors will be crucial in defining the industry’s trajectory as it approaches 2024.

India Automotive Plastics Marke Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Breakup by Vehicle Type:

- Conventional and Traditional Vehicles

- Electric Vehicles

Breakup by Material:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Polycarbonate (PC)

- Polyamide

- Others

Breakup by Application:

- Powertrain

- Electrical Components

- Interior Furnishings

- Exterior Furnishings

- Under the Hood

- Chassis

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145